In most tax cases, when a taxpayer interprets the VAT laws different from the Revenue Department’s interpretation especially the cases involving the issuance or use of VAT invoices, whether the taxpayers act in good faith with full compliance with VAT laws and full VAT remittance or not, the taxpayers will be held liable for penalty. If found that the sale transactions do not constitute “sale” under Thai laws by whatsoever discretionary reasons, the Revenue Department considers that such taxpayer is not entitled to issue VAT invoice, and it will be subject to penalty. As such, in tax assessment notices, the Revenue Department would allege that the issuance or use of illegal VAT invoices by taxpayers intends to ruin the spirit of VAT laws. The arguments against such an unfair accusation of either issuance or use of VAT invoices is extremely difficult. With such aggressive accusation from the authority, the Thai juridical body has trended to rule in favor of the Revenue Department. To taxpayers, it remains in doubt as to whether an unfair allegation against good taxpayers for the ground of issuance or use of illegal VAT invoices would ruin the spirit of VAT laws and the “willingness to pay” principle. A recent positive sign shows in the recent tax ruling that arguments against an unfair allegation of issuance or use of VAT invoices are still possible through proving the court with greater details of proof on the transactions and all aspects that the sale transactions were genuine commercial transactions with support of the evidence and all witnesses. If satisfied, the court would rule in favor of the taxpayer. Summary of the case is provided below.

An SME, being a limited partnership, is one of authorized dealers of Samsung’s cell phones in Pitsanulok province (“Partnership”) was served with a notice of tax assessment from the Revenue Department for the alleged issuance of illegal VAT invoices to its customers and is held liable for penalty of 200% of VAT amount. The allegation was that the Partnership issued VAT invoices without any sale transactions. The reason was the revenue officers did not believe that the sale transactions between the Partnership and its customers were made via telephone or LINE application and delivery of goods sold were made via train or couriers. During the courses of tax audit and tax appeal, the Partnership presented numerous evidence including confirmation letters from the customers to the revenue officers, but such evidence has simply been ignored. It was obvious that, with no concrete evidence, the revenue officers simply assumed that the sale transactions made with its customers were suspicious. For example, the receipts issued by couriers or train station did not identify the quantity of the goods inside each box, the recipients of the goods were neither representative nor employee of the customers. Notwithstanding that the 7% output VAT has been remitted to the Revenue Department, the local tax authority has made VAT assessment and heartlessly imposed 200% penalty against the Partnership.

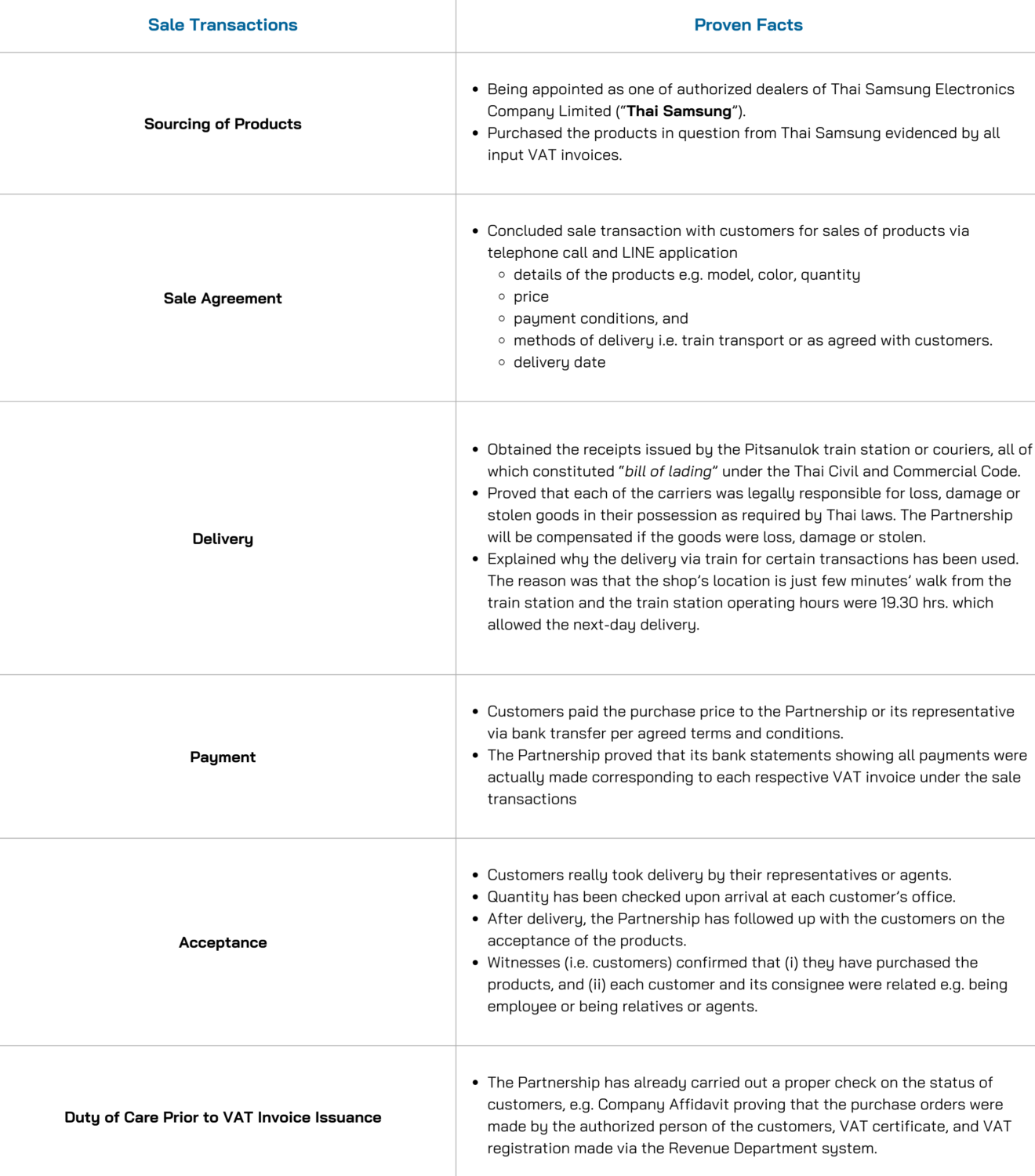

During the court proceedings, the taxpayer had burden of proof on the following:

In May 2024, the Central Taxation Court ruled in favor of the Partnership. The court also viewed that at present it is considered normal in ordinary course of business that taxpayers engaging in commercial transactions can discuss, confirm and conclude the sale transactions via telephone or LINE application, and the Partnership has exercised the duty of care to verify the company affidavit and VAT registration status of the customers especially the facts that the Partnership has asked the customers to make full payments before delivery and the Partnership has followed up the delivery of the products sold as to confirm that the customers have received the products. Proving of the foregoing, the court believed that the sale transactions between the Partnership and the customers were genuine transactions, and the VAT invoices issued by the Partnership were legal. As a result, the Central Taxation Court ruled in favor of the Partnership to revoke the VAT assessments. Further, the Revenue Department appealed the case to the Appeal Court with a request for the deferral of VAT refund to the Partnership until the case is final.

On 30 June 2025, the Court of Appeal for Specialized Cases (Tax Case Division) also affirmed such verdict and ruled in favor of the Partnership. Now the two tax courts overruled the tax assessment notices and ruled that the tax assessment is unlawful. At present, the Revenue Department is in the process of filing another appeal to the Supreme Court. In Thailand, in all cases, tax dispute is not final until it reaches the Supreme Court with no consideration as to whether it consumes much time and costs on taxpayers.